Monthly Archives: December 2012

AIG Is The Best Insurance Play For 2013

Introduction

AIG is an insurance conglomerate that spans the globe, but during the great recession like many other giant financial institutions, AIG got itself into a lot of trouble taking on the counter-party risk of mortgage backed securities. During the 4th quarter of 2008, AIG set the world record for reporting the biggest loss. It lost $99.3 billion dollars in a single quarter.

Despite the hazy past, AIG is the definition of a turnaround story. I anticipate the company to generate outstanding earnings growth going forward, and that investors will be able to earn some phenomenal yields by investing into AIG.

Qualitative Analysis

Source: Information pertaining to AIG came from the shareholder annual report

The company currently operates one of the largest insurance networks in the world, with more than 85 million clients in 130 countries. AIG is split into four business divisions: Chartis, SunAmerica Financial Group, Aircraft Leasing, and other operations.

Chartis offers a unique portfolio of insurance products and services. The insurance products are: casualty, property, financial lines, and specialty. Chartis conducts its business through multiple entities such as: New Hampshire Insurance Company, American Home Assurance Company, Lexington Insurance Company, AIU Insurance Company, Chartis Overseas, Fuji Fire & Marine Insurance Company Limited, Chartis Europe Holdings Limited, and Chartis Europe.

SunAmerica Financial Group – offers a comprehensive suite of products such as: term life, universal life, fixed/variable annuities, mutual funds, financial planning. The SunAmerica Financial Group operates under these subsidiaries: American General Life Companies (American General), Variable Annuity Life Insurance Company (Western National), SunAmerica Retirement Markets (SARM).

AIG’s other operations primarily consisted of derivatives trading, and aircraft leasing. The other operations: International Lease Finance Corporation, AIG Markets, United Guaranty Corporation, AIG Financial Products, and AIG Trading Group Inc.

Currently AIG generates 91% of its revenue through the SunAmerica Financial Group, and Chartis.

AIG’s current management strategy remains simple: by 2015 achieve return on equity above 10%, generate share growth in mid-teens, grow insurance divisions, and reinvest retained earnings.

AIG aggressively competes with Berkshire Hathaway (BRK.A/BRK.B), The Travelers Companies (TRV), Chubb (CB), Allstate (ALL), Loews (L), Progressive (PGR), Hartford Financial Services (HIG), CNA Financial (CNA), among many others.

Technical Analysis

The stock has been on a continuous up-trend since November 2012. On 12/24/2012 the stock is between a very narrow symmetrical triangle formation. I anticipate the stock to break out no later than the 26th or 27th, meaning that the stock will be forced to make a major move.

Source: Chart from freestockcharts.com

The stock is trading above the 20-, 50-, and 200- Day Moving Averages. The stock will experience further upside through 2013, as investors have under-bought the growth prospects of the company.

Notable support is $23.00, $27.30, and $30.60 per share.

Notable resistance is $37.50, $46.00, and $60.00 per share.

Street Assessment

Analysts on a consensus basis have high expectations for the company going forward.

| Growth Est | AIG | Industry | Sector | S&P 500 |

| Current Qtr. | -113.40% | -99.90% | -93.80% | 9.50% |

| Next Qtr. | -48.50% | -99.80% | -92.70% | 15.30% |

| This Year | 266.70% | 99.80% | 23.30% | 7.20% |

| Next Year | -6.70% | 20.80% | 6.90% | 13.10% |

| Past 5 Years (per annum) | -42.91% | N/A | N/A | N/A |

| Next 5 Years (per annum) | 21.93% | 13.20% | 10.60% | 8.72% |

| Price/Earnings (avg. for comparison categories) | 9.41 | 19.56 | 13.83 | 14.69 |

| PEG Ratio (avg. for comparison categories) | 0.43 | 1.67 | 0.95 | 1.41 |

Source: Table and data from Yahoo Finance

Analysts have high expectations, as analysts on a consensus basis have a 5-year average growth rate forecast of 21.93% (based on the above table). This growth rate is above the industry average for next 5-years (13.20%).

| Earnings History | 11-Dec | 12-Mar | 12-Jun | 12-Sep |

| EPS Est | 0.63 | 1.12 | 0.57 | 0.86 |

| EPS Actual | 0.82 | 1.65 | 1.06 | 1 |

| Difference | 0.19 | 0.53 | 0.49 | 0.14 |

| Surprise % | 30.20% | 47.30% | 86.00% | 16.30% |

Source: Table and data from Yahoo Finance

The average surprise percentage is 44% above analyst forecast earnings over the past four quarters (based on the above table).

Forecast and History

| Year | Basic EPS | P/E Multiple |

| 2003 | $ 3.10 | 21.38 |

| 2004 | $ 3.77 | 17.42 |

| 2005 | $ 4.03 | 16.93 |

| 2006 | $ 5.38 | 13.32 |

| 2007 | $ 2.40 | 24.29 |

| 2008 | $ (37.84) | – |

| 2009 | $ (93.69) | – |

| 2010 | $ 14.75 | 3.27 |

| 2011 | $ 8.60 | 2.7 |

| 2012 | $ 3.74 | 9.41 |

Source: Table created by Alex Cho, data from shareholder annual report

The EPS figure shows that throughout the 2003-2006 period earnings were growing due to favorable economic conditions. Then the company was adversely affected by the great recession throughout 2007-2009, as the net income rapidly declined, and AIG eventually logged the biggest loss in corporate history. During 2010 the company was able to generate a profit by restructuring the company; this involved selling business units, which inflated earnings by $17.7 billion dollars. Once the United States economy exited the recession in 2010-2012 the company earnings have improved, albeit gradually. In 2011 the abnormal earnings of $8.60 were due to a provisional benefit from taxes worth $18.03 billion dollars. The improvements in net income for 2010-2011 were one-time events and should not be considered a part of the long-term earnings growth trend. So in essence, 2012 is likely to be the most normal year for AIG over the past 5 years.

Source: Table created by Alex Cho, data from shareholder annual report

By observing the chart we can conclude that the business is somewhat cyclical and is affected by macroeconomics. Therefore one of the largest risk factors to AIG is the slowing of international gross domestic product growth. So as long as the global economy continues to grow, the company will generate reasonable returns over a 5-year time span based on the forecast below.

Source: Forecast and table by Alex Cho

By 2018 I anticipate the company to generate $10.19 in earnings per share. This is because of earnings growth, improving global outlook, earnings management and continued development overseas.

The forecast is proprietary, and below is a non-linear chart indicating the price of the stock over the next 5-years.

Source: Forecast and chart by Alex Cho

Below is a price chart incorporating the past 10 years and the next 6 years. Detailing 16 years in pricing based on my forecast and price history on December 31st of each year.

Source: Forecast and chart created by Alex Cho, data from shareholder annual report, and price history is from Yahoo Finance.

*The period 2003-2008 were price quotes based on pre-split stock prices (multiply by 20 to accurately calculate the price of the shares between 2003 and 2008). On 7/01/2009 the stock had a 1:20 split (reverse split).

Investment Strategy

AIG currently trades at $35.20. I have a price forecast of $37.94 for 2013. AIG is in a long-term up-trend. I anticipate momentum in the price of the stock, as the growth rate offers compelling stock appreciation for the foreseeable future.

Short Term

Over the next twelve months, the stock is likely to appreciate from $35.20 to $38.60 per share. This implies 9.6% upside from current levels. The technical analysis indicates an up-trend (break above the symmetrical triangle formation). While the previously mentioned price forecast using fundamental analysis further supports the trade set-up.

Investors should buy AIG at $35.20 and sell at $38.60 to pocket short-term gains of 9.6% in 2013. This return is pretty measly, meaning that short-term investors would likely do better investing in other opportunities.

Long Term

The company is a great investment for the long-term. I anticipate AIG to deliver upon the price and earnings forecast despite the risk factors (macroeconomic, competition, etc.). AIG’s primary upside catalyst is international development, and earnings management. I anticipate the company to deliver upon my forecasted price target of $100.12 by 2018. This implies a return of 185% by 2018. This rate of return is exceptional, considering AIG has a market capitalization of $52B. The extra liquidity makes this a compelling growth investment for institutional investors who require higher liquidity.

Conclusion

Buy AIG on long-term growth. AIG has not died off the surface of the earth; it is more stubborn than a roach.

The conclusion remains simple: buy AIG.

Retrived From: http://seekingalpha.com/article/1082001-aig-is-the-best-insurance-play-for-2013?source=email_investing_ideas&ifp=0

6 Micro Caps To Add To Your Portfolio For 2013

Micro Caps are often the epitome of boom or bust scenarios. I think it’s important to have some speculation in any portfolio but often times people stay away from Micro’s as they are usually in the development stage. It’s a dangerous game, most of the time, because the outcome is binary: win big or lose big. There is seldom middle ground, so one must choose carefully which stocks they wade into.

With the new year upon us, it’s time to reposition the portfolio and look ahead into 2013 and early 2014. My personal strategy is to allocate 5-10% of the total portfolio to micro cap speculation stocks. I’ve chosen six for this year (no particular order):

1. Pershing Gold (PGLC)

· Market Cap: $110 million

· Catalyst: New Resource Estimate

Pershing Gold is a development gold miner that has yet to see revenues. The company has some strong backers for being such a small company with billionaire investor Philip Frost being one of the most notable. Stephen Alfers left Franco Nevada to run this company and Coeur d’Alene Mines (CDE) has also made a sizable investment in the early stages of PGLC.

Development stage mining companies generally are extremely speculative, but this one seems different considering the cast of characters involved. Sure, the dreaded "its different this time" phrase is there, but the thesis is strong nonetheless. With an aggressive drill program having taken shape in 2012, PGLC is waiting on a revised estimate of resources. With good news on this front, PGLC will likely gain considerably from here. Alfers has said he expects to be producing gold in 2014.

2. General Moly (GMO)

· Market Cap: $345m

· Catalyst: Finalizing the Chinese Bank Loan

General Moly will mine and produce Molybdenum, with two mines but only one on the near term horizon. It owns 80% of Mt. Hope (the remaining 20% belongs to POSCO) mine that is expected to have an average annual production rate of 40m pounds of Moly (32m net to GMO). In the most recent presentation, GMO says it expects cash costs to be roughly in the $5-$6 range. This leaves significant profit upside due to the fact that its production is 100% committed for the first 5 years with a floor at $15.

For this reason alone, GMO is a buy. That’s a margin at minimum of around $9/lb. Sure it will take a year or two to get costs down to these levels, but even if the company is wrong on costs, and it comes in at $10/lb, it still presents significant profits. The structure of the off-take allows GMO to participate in Molybdenum price appreciation to a certain extent, but the floor being capped at around $15 is what I’m focused on. If the company can execute and come in at $6/lb cash cost, we are looking at a minimum of $288m in gross profit. Not bad for a company with a $345m market cap?

Once the Chinese Bank Loan is finalized, full on construction will begin. This will remove a major risk of not getting financed. The loan should be complete by the end of Q1 in 2013 and it will take roughly 2 years to complete construction. That puts the company into 2015 before seeing revenues. GMO has about $28m in cash, and the bank financing of $665m coupled with equity tranches received from POSCO and Hanglong should be enough capital to get it through to production.

3. Uranium Energy Corp (UEC)

· Market Cap: $216m

· Catalyst: Recovery in Uranium Prices

UEC is a small cap, debt-free, unleveraged American uranium producer. Despite many doubts over the future of nuclear energy, I am in the camp that countries are not just going to do away with the source of energy. The future of the space is in turmoil after the Japanese disaster, but like anything else, things just take time to come back to equilibrium. I believe in the stability of long-term nuclear energy. UEC may not be an overnight success, but long-term, the fundamentals are in tact. The company is growing production, and operates in the safe confines of the U.S.A.

4. Neuralstem (CUR)

· Market Cap: $75m

· Catalyst: Q1 2013 results of ALS treatment

I often do not start paying attention to biotechs until sometime in phase II testing, as there are just too many things that can go wrong. But CUR caught my attention and I decided to give it a look. It is targeting the deadly disease ALS, better known as Lou Gherig’s disease. Though the company just completed Phase I results with only 18 patients enrolled, the data was extremely positive in one patient who showed not only stabilization of the disease, but improvement, which is unheard of in ALS.

The sample size was small, and only wanted to prove safety, which it did successfully. The treatment showed signs of stabilization in other patients as well. For Phase II trials the company will target patients that are a bit healthier and may have just been diagnosed or in relatively early stages of ALS. The hope is to catch things soon enough and the injection of CUR’s stem cells will stabilize this deadly disease.

The last surgery injection was August 2012, which targets sometime in mid- to late Q1 2013 for an update on the trials. The early nature of this one makes me cautious, but I like what I have seen so far and think it warrants a look.

5. Galena Biopharma (GALE)

· Market Cap: $106m

· Catalyst: Continued Results from Breast Cancer Drug

I have mixed emotions on GALE for the simple fact that data it released this month was overwhelmingly positive, yet the stock went nowhere. Often times, price is truth. Analysts have trotted out with lofty price targets for this name yet investors are not buying at these levels. With that being said, the data was indeed positive and the company is pushing into Phase III trials for a treatment to breast cancer.

The market in breast cancer is vast worldwide, especially in the U.S. There is a lot of debating about the results from GALE, namely from Adam Feuerstein of The Street. It is always important to listen to the other side of the story.

The reason I think GALE will have a solid 2013 is because hype around these results will be excessive leading to the next release. Anytime there is positive Phase II results, the hype around Phase III will certainly be there. This is one of those I would consider selling a significant portion- if not all of the position- leading up to the results as there will likely be a run up in price. There is still plenty of time to make that decision, and because of the secondary it now trades at an attractive entry point.

6. Sarepta Therapeutics (SRPT)

· Market Cap: $629m

· Catalyst: Possible Accelerated approval of DMD Drug

Sarepta may be the most compelling of this list. Results from Eteplirsen have been overwhelmingly positive. If you haven’t heard of this stock and are wondering if the drug works, you can start by reading this article from a mother of two boys with DMD; only one of which is on the drug. Its a real life scenario that speaks to the potential of this drug. SRPT has had a monster year in 2012, and is poised to continue into 2013.

If the FDA grants accelerated approval, the company could begin commercial product ramp sometime in late 2014 or early 2015 which is right around the corner (from an investment standpoint). With no cure currently for DMD the market potential is lucrative. SRPT just did an at the money equity offering that was over subscribed. Most of the time investors want a discount to current prices in this type of deal, they received no such discount in the latest round.

After the secondary, SRPT has almost $150m in cash which will be enough to get it through Phase III and possibly even commercialization. SRPT does not HAVE to find a partner now, the company can take the right deal that comes its way. I am very bullish on SRPT and think this one could be the next big blockbuster drug.

Retrieved From: http://seekingalpha.com/article/1083611-6-micro-caps-to-add-to-your-portfolio-for-2013?source=email_investing_ideas&ifp=0

Samsung Should Come To NYSE Or Nasdaq

Samsung (SSNLF.PK) is one of the largest companies in the world. The company employs more than 300,000 people in more than 100 countries and it is highly profitable. Samsung is probably the only company in the world that causes Apple’s (AAPL) management to lose sleep at night. If the company was trading in one of the American stock exchanges such as NYSE or Nasdaq, it would be probably rated as a "strong buy" because of its strong fundamentals. American investors can get the company’s ADR (American Depositary Receipt) shares; however, these shares don’t have much volume or liquidity.

The American Depositary Receipt Shares

Currently, Samsung’s ADR shares trade for $1399 per share. Keep in mind that these shares don’t reflect the entire company of Samsung; rather it reflects Samsung Electronics, which is only part of the Samsung corporation. The average volume on these shares is only 66. Some days, the volume will be zero as the shares will not change hands on certain days.

Of course, this makes it a very difficult investment for American investors. The low volume of this stock makes the share price extremely volatile and easy to manipulate. In addition, the low liquidity makes it difficult for people to get out when they feel like selling their shares.

The Korean Shares

In South Korea, the company’s shares are doing really well. Being the largest company in the country helps Samsung attract investors from different levels and backgrounds across the country. Samsung’s Korean shares are up by 45% since the beginning of the year. In the last 3 years, the share price has nearly tripled. The company’s current market value is $215 billion and its P/E value is as low as 11. Given the company’s growth prospects and cash reserves, the share price could be a lot higher than it is today.

Why Samsung Should Care?

So, we established that Samsung is a great investment and American investors could benefit greatly from it if Samsung was in NYSE or Nasdaq, but why should Samsung care about American investors? I believe that having regular shares traded in an American exchange would help the company greatly.

First of all, it’s good for business. Americans might be more likely to buy Samsung products if they can buy Samsung’s shares. I know a lot of people that choose Apple products over competition partly because they own Apple shares. When you own a part of a company, you want that company to do well, so you feel good about buying their products. When you can’t buy shares of a company conveniently, it feels like you can’t build a strong rapport with the company. Even though all Apple products are built in China, we perceive Apple’s products as American products. After all, perception can be as strong as (if not even stronger) than the reality in many cases.

Second, in times of uncertainty, American markets tend to over-perform foreign markets. There is far less volatility in American stock exchanges than the rest of the world. This is especially true after the last global recession in 2009. In 2011, American exchanges were some of the very few exchanges that ended the year on a positive note, whereas most other exchanges ended the year in red territory. While the developing markets will usually outperform the developed markets at a time of global economic boom, the current economic outlook will favor the developed markets until the world economy can get going again. If Samsung is included in one of the major American exchanges, this can help the company to protect or increase its market value greatly.

Outlook for Samsung

Samsung will remain as the world’s largest mobile phone supplier for the foreseeable future. Apple doesn’t offer the variety of products Samsung does, and Nokia (NOK) is not likely to pass Samsung in volume anytime soon. Not only Samsung sells a lot of phones, it actually makes a lot of profits in these phones too. In fact, Samsung and Apple account for 106% of all global profits in the smart phone market. These companies claim more than 100% share in global profits because all other major smartphone companies fail to be profitable, which gives them a negative share in global profits.

Samsung’s management really knows how to take a product, improve it in many ways, sell it and continue to get high profit margins. When Apple first started to sell its smartphones for a huge premium, many people thought that no other company could get away with this. Samsung actually ended up getting away with selling its products with a similar premium to Apple’s products.

If Samsung was trading in an American exchange, its market value would be easily double of what it is today. Despite being a strong growth story, the company trades for a forward P/E of 9 and current price to cash flow ratio of 7. Given Samsung’s growth rate and dominance in the smartphone market, it could easily support a P/E ratio closer to 20 and a price to cash flow ratio closer to 15.

As for Samsung’s legal battles with Apple, I don’t think the battles will result in any serious damage for either side. So far, both sides have gained some minor victories over the other, but there hasn’t been any decision that can make a real impact to either company. Samsung might get fined here and there, but as long as the company doesn’t get its flagship products banned in the USA or Europe, things should be fine. It’s only a matter of time before the judges get sick of these legal battles and start dismissing cases all around the world.

Samsung is doing so well in the smartphone market but this is not the only market where Samsung is crushing the competition. The company is also very profitable in other products such as TVs and other home electronics. In addition, Samsung is a direct supplier for many companies including Apple, so even if it loses some market share to Apple, it will still earn some money.

Of course, the company is not absolutely perfect as no company is. A lot of times Samsung is being criticized for having low quality products that don’t last a long time, ripping off ideas from competitors and not being very innovative. Apple is far more likely to redefine the technology than Samsung, but Samsung is just as likely as Apple to turn the new technology into profits. Keep in mind that Samsung doesn’t enjoy an ecosystem like Apple does, and it mainly earns money through selling hardware. On the other hand, as long as the company can turn products into cash flow, it will be a good investment. Keep in mind though that I don’t currently recommend buying Samsung shares because the ADR versions of these shares have extremely low volume, high volatility and low liquidity. This is why I hope that Samsung’s management will make the right decision and list the company’s shares in an American exchange. If it does that, the company will be one of the strongest buys that ever existed.

As for companies that are already listed in American exchanges, Apple is still the king of kings

Retrieved From: http://seekingalpha.com/article/1082161-samsung-should-come-to-nyse-or-nasdaq?source=email_investing_ideas&ifp=0

Should You Sell Cisco Like CEO John Chambers Is?

For those that were busy getting ready for Christmas, they might have missed the announcement that Cisco (CSCO) CEO John Chambers plans to sell 2.8 million shares. This represents about a third of his position, when counting all of his un-exercised stock options. For those that didn’t see this, it might be a major concern that their company’s CEO is selling a large portion of his holdings. However, there have been rumors that Chambers is expecting to retire in a couple of years, and this share selling might be the start of that process. The question is, with Cisco stock near the upper end of its recent range, should investors start to bail on this name as well?

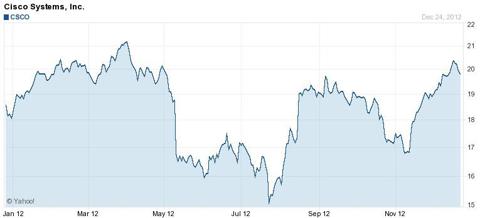

Cisco shares have risen nicely since the company reported its fiscal first quarter results. The company did beat on both the top and bottom line, and guidance was decent. As I had stated going into the report, Cisco needed to prove itself. That’s because the previous quarter’s report was overshadowed by the huge dividend raise. Cisco shares have risen nicely since the mid-November report, as you can see from the chart below. As of Wednesday’s close, Cisco shares are just 7% from their 52-week high, and up more than 33% from the 52-week low.

(Source: Yahoo Finance)

In terms of where expectations stand, for fiscal Q2, Cisco guided to revenue growth in a range of 3.5% to 5.5%. On the day that earnings were reported, analysts were looking for 4.2%. Currently, analysts are looking for 4.6% growth. In terms of earnings per share, Cisco guided to a range of $0.47 to $0.48, non-GAAP. Analysts were expecting $0.47 then, and are expecting $0.48 now. I don’t think that the guidance is that worrisome at the moment. However, we have more than a month until Cisco reports that quarter, so if expectations continue to climb, I might worry then. Fiscal cliff issues could cause business spending to be weak, and I think Cisco could be in trouble then.

So where does that leave Cisco? Well, in the following table, I’ve compared Cisco against a few other names. On one hand, you have networking names like Riverbed Technology (RVBD) and Juniper Networks (JNPR). On the other hand, you have Cisco being seen as a top tier tech name, like Microsoft (MSFT) and Apple (AAPL). So the table below shows the revenue and earnings growth forecast for each, as well as the price-to-earnings multiple. For Cisco, Microsoft, and Apple, I am using the current fiscal year that ends sometime in 2013. For Riverbed and Juniper, I’m using the 2013 full year, which is their fiscal year.

*Adjusted for normal 52-week period. Apple had an extra week in its previous fiscal year.

So what are the key takeaways? Well, when it comes to top tier tech names, Cisco is a bit overvalued. Cisco offers a bit less revenue growth than Microsoft, but trades at a higher price to earnings, based on their fiscal year forecasts. Additionally, Microsoft is spending more on its buyback program, and Microsoft’s dividend yield is about 60 basis points per year higher currently. While Apple doesn’t have the yield or buyback size of Cisco currently, Apple is still growing at a tremendous rate, and only trades for a 3.5% premium to Cisco. You may argue that Apple is undervalued, but you could also argue that Cisco is overvalued.

In terms of Cisco versus Juniper and Riverbed, Cisco offers a lower amount of growth than Riverbed, which is why you get a significant discount on the stock. Juniper is in the midst of a turnaround, with revenues forecast to decline in 2012, then rebound in 2013. Juniper is also expected to see a huge decline in earnings this year, followed by a substantial rebound in 2013. Thus, investors are looking to pay up for what they think will be an earnings turnaround.

In terms of just Cisco, the valuation has certainly expanded over the past few months. As you can see from the table below, Cisco is up more than 7.5% in the past three months alone, and expectations really haven’t changed. Cisco has done quite well in the short term, but over the longer term has been a bit of a dog.

This is why I would encourage caution with Cisco at current levels. Cisco has had a nice run lately, and I don’t want investors to buy at the peak again. Cisco popped tremendously in August to over $19 after the earnings report, but slowly faded back to under $17. While those that bought at $19 are up now, they could have tripled their gains had they waited for the pullback.

So this brings me back to the original question. Should Cisco investors bail? At this point, if you are concerned about rising tax rates and want to lock in your gains at a lower tax rate, you might want to consider selling your Cisco position with Cisco up 10% over the past year and 21% in just 6 months. Cisco has had a nice run, but it might be time to take profits.

The valuation doesn’t fit here, so let’s look at two ways to find a better entry point. The first is price-to-earnings. Cisco is currently trading at 10.16 times this year’s expected earnings of $1.96. Given how I’ve stated the name is overvalued against other tech names, two potential entry points would be 9.5 and 9.0 times expected earnings. Those price points would be $18.62 and $17.64, respectively. The other method is to use dividend yield. Cisco’s current yield is 2.81%, so the next logical entry points using the yield would be 3.00% and 3.25%. The prices for those entry points would be $18.67 and $17.23, respectively. I think those would be much better entry points for Cisco than at the nearly $20 shares fetch currently.

The Christmas Eve timing of this announcement from Cisco was interesting in the sense that most probably did not see it. If Chambers was selling a small portion of his shares, I don’t think I’d be as worried, but he’s selling a large portion of his shares, which gives me some pause. I’m not recommending a short position here, because if we get any good news on the fiscal cliff issue, U.S. markets will shoot higher. But for those looking to jump in on Cisco, I think you can find a better entry point. For those already in the name, you might want to take some profits here and buy back at a lower price.

Additional disclosure: Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Retrieved From: http://seekingalpha.com/article/1083751-should-you-sell-cisco-like-ceo-john-chambers-is?source=email_investing_ideas&ifp=0

3 Gold Stocks With Recent Insider Buying

Early 2013 may be pivotal for gold stocks. Many of the smaller gold mining stocks have seen heavy tax loss selling during the past 2-3 months. This development can be seen also from the chart of Market Vectors Junior Gold Miners (GDXJ).

I believe it is very likely that the trend reverses early next year. Also, the insiders of many of these small cap mining companies have been bargain hunting during the past two months. In this article I will feature three mining companies that have seen insider buying during the past 30 days.

1. Vista Gold (VGZ) is focused on the development of the Mt. Todd gold project in Northern Territory, Australia, to achieve its goal of becoming a mid-tier gold producer. Vista is advancing exploration on its Guadalupe de los Reyes gold/silver project in Mexico and has granted Invecture Group, S.A. de C.V. a right to earn a 62.5% interest in the Los Cardones (formerly named Concordia) gold project in Mexico. In addition, the company holds a ~28% interest in Midas Gold‘s (MDRPF.PK) Golden Meadows Project in the Stibnite-Yellow Pine District in Idaho. Vista’s other holdings include the Awak Mas gold project in Indonesia and the Long Valley gold project in California.

Insider buys

Sun Valley Gold purchased 1,272,000 shares and 636,000 warrants on December 21 pursuant to a public offering. Sun Valley Gold currently holds 12,084,310 shares or 14.8% of Vista Gold and 3,643,246 warrants of Vista Gold.

Financials

The company reported the third-quarter financial results on November 5 with the following highlights:

| Revenue | $0 |

| Net income | $12.3 million |

| Cash | $14.9 million |

| Investments | $90 million |

Vista Gold announced on December 21 the closing of its previously announced public offering of 4,182,550 units, which includes 545,550 units issued pursuant to the full exercise of the underwriters’ over-allotment option. The units were offered at a price to the public of $2.75 per unit. Each unit was comprised of one common share of the company and one-half of one common share purchase warrant, with each whole warrant exercisable to purchase one common share of the company’s stock at a price of $3.30 for a period of 24 months from the closing of this offering.

The gross proceeds of the offering, before expenses, were $11,502,013. The company intends to use the net proceeds of the offering to advance its Mt. Todd gold project in Australia, including completing a bankable feasibility study, for corporate administration, to complete a preliminary economic assessment on Guadalupe de los Reyes gold/silver project in Mexico, and for working capital requirements and general corporate purposes.

Upcoming milestones

The company has initiated a preliminary feasibility study of Mt. Todd gold project, with results expected early Q1 2013, to evaluate the two-phased development strategy and to accelerate the environmental permitting process.

My analysis

The stock has a $1.75 price target from the Point and Figure chart. There has been one insider buying the shares and there have not been any insiders selling the shares during the past 6 months. The company has five projects containing a total of 12.5 million ounces of measured and indicated resources and 3.7 million ounces of inferred resources. The next major catalyst for the stock will be the preliminary feasibility study results of Mt. Todd gold project due early Q1 2013.

2. Veris Gold (YNGFD.PK) is a growing mid-tier North American gold producer in the business of developing and operating gold mines in geo-politically stable jurisdictions. The company’s primary asset is the permitted and operating Jerritt Canyon gold mine located 50 miles north of Elko, Nevada, USA. The company also holds a diverse portfolio of precious metals properties in British Columbia and the Yukon Territory, Canada, including the former producing Ketza River mine. The company’s focus has been on the re-development of the Jerritt Canyon mining and milling facility.

Insider buys

· Randy Reichert purchased 50,000 shares on December 18-21 and currently holds 70,000 shares or less than 0.1% of the company. Randy Reichert is Co-Chief Executive Officer, Chief Operating Officer and Director of the company.

· Shaun Heinrichs purchased 23,075 shares on December 18-21 and currently holds 145,075 shares or 0.1% of the company. Shaun Heinrichs is Co-Chief Executive Officer, Chief Financial Officer and Director of the company.

· Graham Dickson purchased 1,100 shares on October 11 and currently holds 2,807,100 shares or 2.6% of the company. Graham Dickson is Senior Vice President Acquisitions & Corporate Development and Director of the company.

Financials

The company reported the third-quarter financial results on November 9 with the following highlights:

| Revenue | $51.5 million |

| Net income | $9.0 million |

| Cash | $6.9 million |

| Debt | $172.3 million |

| Gold production | 35,524 ounces |

On December 18 Veris Gold announced that it had closed its previously announced offering of units of the company. The company sold 7,200,000 units at a price of $2.10 per unit representing aggregate gross proceeds of $15,120,000.

Outlook

· Expected 2012 gold production of 110,000 ozs.

· Currently on 150,000 ozs/year run rate and ramping up to 180,000-200,000 ozs in 2013 (not including toll milling).

· Cash costs declining from average of approximately $1,600/oz in H1 2012 to an estimated $1,015/oz Au in Q3 2012 and forecast $885/oz in Q4 2012, driven primarily by increased throughput.

My analysis

There have been three different insiders buying and there have not been any insiders selling the shares during the last 6 months. The company’s current gold reserves at Jerritt Canyon are 1.06 million ounces, Measured and Indicated resources are 1.26 million ounces, and Inferred resources are 748,000 ounces. The company has significant potential for resource expansion. There is a near-term opportunity to upgrade approximately 500,000 ounces of resources to reserves at the Mahala Basin. I have a bullish bias for the stock currently based on the solid fundamentals.

3. Kaminak Gold Corporation (KMKGF.PK) is exploring the Coffee Gold Project, a high-grade oxidized gold project in the emerging White Gold District of the Yukon Territory, Canada. In 2010, Kaminak executed the first ever drill program at Coffee, and since then, 16 gold discoveries have been drilled to date demonstrating that Coffee is Canada’s newest gold district. In less than 2.5 years, Kaminak has established a maiden National Instrument 43-101 Mineral Resource Estimate of ~3.2 million ounces of gold at Coffee.

All of the gold discoveries drilled at Coffee were made by drilling directly underneath gold-in-soil anomalies. Lack of glaciation over the Coffee property has allowed in-situ soil-sampling to be employed as a highly effective and low cost exploration tool. Presently, there are over 20km of untested soil anomalies on the property that warrant drill testing, and only 15% of the 150,000 acre property has experienced systematic grid soil sampling.

Insider buys

· John Robins purchased 199,500 shares on December 14 and currently holds 506,249 shares or 0.6% of the company. John Robins serves as the Chairman of the Board.

· Garth Kirkham purchased 10,000 shares on November 20 and currently holds 15,000 shares or less than 0.1% of the company. Garth Kirkham serves as a director of the company.

Financials

The company reported the second-quarter financial results on August 27 with the following highlights:

| Revenue | $0 |

| Net loss | $2.4 million |

| Cash | $17.2 million |

Kaminak Gold announced on October 11 that the company had closed the bought deal private placement financing announced on September 17, 2012 and that the over-allotment option was fully exercised. The company issued 4,810,000 Class A common shares at a price of $2.50 per share for aggregate gross proceeds of $12,025,000. The company intends to use the gross proceeds of the offering to conduct exploration activities on its Coffee project located in the White Gold District, Yukon.

Upcoming milestones

· Minimum $12,000,000 program (fully-funded) beginning in March

· Drill discovery of additional oxide, near-surface gold zones

· Extensive metallurgical testwork

· Drill expansion and infill of known gold zones

· Ultimate goal to deliver a PEA by the end of 2013

· Board approved program and budget expected January 2013

My analysis

The stock has a $0.5 price target from the Point and Figure chart. There have been two different insiders buying and there have not been any insiders selling the shares during the last 6 months. The stock has a 3.5% insider ownership and a 20% institutional ownership. The next major catalyst for the stock will be the Preliminary Economic Assessment for the Coffee Gold project due by the end of 2013. I have a neutral bias for the stock currently based on the early stage of the current project.

Retrived From: http://seekingalpha.com/article/1081921-3-gold-stocks-with-recent-insider-buying?source=email_investing_ideas&ifp=0